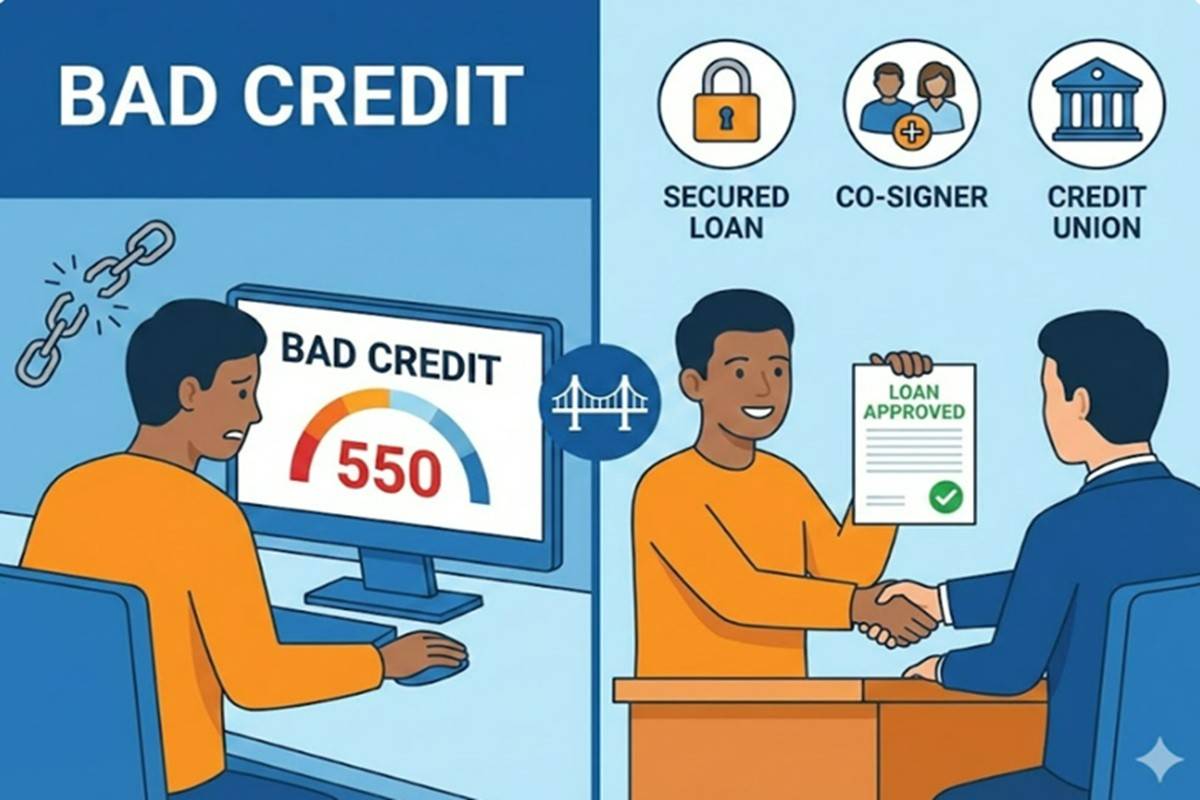

A low credit score can feel like a roadblock—especially when you urgently need funds. Whether it’s an unexpected medical bill, a wedding expense, or a last-minute emergency, finding a lender who trusts your repayment capability becomes challenging. Most banks and financial institutions in India consider a credit score of 650 and above as a green signal. Anything lower often invites higher scrutiny, stricter eligibility checks, or outright rejection.

But here’s the good news: a low credit score doesn’t automatically disqualify you from getting a loan. With evolving digital lending models and better data-driven underwriting, platforms like PayMe now offer accessible loan options even for individuals working toward rebuilding their credit profile.

This detailed guide explains why your credit score matters, what options you have when the score isn’t ideal, and how you can easily apply for a personal loan—even with a less-than-perfect score.

What Causes a Low Credit Score?

Before exploring solutions, it’s crucial to understand why your credit score slipped. A bad or below-average credit score (typically below 650) can result from:

1. Missed or Late EMI Payments

Failing to make timely repayments on loans or credit cards negatively impacts your score.

2. High Credit Utilization

Using more than 30–40% of your available credit limit can signal high dependency on credit.

3. Errors in Credit Reports

Incorrect loan entries, old defaults that were repaid, or inaccurate credit card information can reduce your score significantly.

4. Frequent Loan Applications

Applying for multiple credit products in a short time results in hard inquiries, which temporarily lower the score.

5. Lack of Credit History

Surprisingly, having no credit footprint can also make lenders hesitant.

Can You Get a Loan with a Bad Credit Score?

Traditionally, banks hesitate to lend to low-score applicants. But today, the lending landscape is changing—thanks to fintech innovation.

Why PayMe is Different

PayMe understands that a credit score, while important, does not tell the whole story. A borrower may have:

-

A stable monthly income

-

A good repayment capacity

-

Genuine errors in their credit report

-

Temporary financial setbacks

This is why PayMe evaluates applications using a holistic approach—beyond traditional scoring models.

Whether your requirement is small (₹500–₹10,000) or moderately large (up to ₹5,00,000), PayMe’s quick loan products are designed to support individuals across income brackets and credit profiles.

Quick & Small Personal Loans: Easy, Fast, and Accessible

Personal loans at PayMe are tailored to help customers access funds quickly without complex paperwork. The key features include:

✔ Instant Processing

Most approvals are completed within a few hours.

✔ Completely Digital Process

No branch visits, document couriering, or physical signatures.

✔ Loans starting from ₹2000

Perfect for micro-needs or emergency top-ups.

✔ Flexible Tenures

Choose a tenure that suits your budget and repayment comfort.

✔ No Hidden Charges

Transparent fees and clear terms—always.

✔ Credit Score Not a Deal Breaker

PayMe considers multiple parameters while evaluating your application.

Documents Needed to Apply for a Personal Loan

Documentation is intentionally kept minimal and simple. PayMe asks only for what is necessary to ensure safety, verification, and compliance.

For Salaried Individuals

-

Identity Proof: PAN Card, Passport, Driving License, Voter ID

-

Address Proof: Passport, Utility Bill, Voter ID, Driving License, Ration Card, Rent Agreement, Bank Statement

-

Signature Proof: PAN, Passport, etc.

-

Income Proof:

-

Last 3 months’ salary slips, and

-

Form 16 or Income Tax Returns

-

For Self-Employed Individuals

-

Identity Proof: PAN, Passport, Driving License, Voter ID

-

Address Proof: Same as above

-

Signature Proof: PAN, Passport, etc.

-

Income Proof:

-

Last year’s ITR

-

Business Proof: Registration certificate, GST/service tax registration, trade license, etc.

-

These basic documents allow PayMe to verify your identity, income stability, and repayment capacity—without excessive requirements.

How to Apply for a Personal Loan at PayMe

The application process is designed for convenience and speed:

Step 1: Register on the PayMe App

Enter your mobile number to create your profile.

Step 2: Upload KYC Details

Submit your identity, address, and signature proofs digitally.

Step 3: Provide Income Documents

Upload salary slips, bank statements, or ITR depending on your occupation.

Step 4: Get Approved & Receive Funds

Once verified, the loan amount is credited to your bank account—often on the same day.

That’s it. No long queues, no repeated visits, and no complicated forms.

Why Getting a Loan Through PayMe is Easier—Even with a Low Credit Score

1. Alternative Underwriting

Instead of relying solely on the credit score, PayMe considers real-time financial data, income stability, and transaction patterns.

2. Faster Decisioning

AI-driven assessment minimizes delays common in traditional banks.

3. Suitable for Emergencies

Whether you need money today or in the next few hours, PayMe offers solutions that match urgent requirements.

4. Micro-Loan Options

Even if you are rebuilding your score, small-ticket loans help establish fresh repayment history.

5. Transparent Policies

No hidden fees. No surprise charges. Every fee is clearly disclosed before disbursal.

Tips to Improve Your Credit Score While Borrowing

Getting a loan with a low credit score is possible—but rebuilding it is equally important.

Here’s how you can gradually boost your score:

-

Always pay EMIs on time

-

Reduce credit card utilization below 30%

-

Avoid applying for too many loans at once

-

Monitor your credit report regularly and report errors

-

Maintain a healthy mix of secured and unsecured credit

-

Close unused credit accounts only after review

Small financial habits can help transform your credit profile within months.

Conclussions:

A low credit score may complicate your loan journey, but it doesn’t have to stop you from accessing funds. With digital lenders like PayMe, getting a personal loan is now simpler, faster, and more inclusive.

Whether you’re dealing with unexpected bills, planning important life events, or simply need a financial cushion, PayMe’s transparent and customer-friendly loan solutions are designed to support you—no matter where you stand in your credit journey.

Join thousands of satisfied customers who trust PayMe for instant loans, transparent processes, and reliable financial support.

Your credit score may be low, but your possibilities don’t have to be.

Also, check:

- Difference in Repo & Reverse Repo Rates: Impact on Personal Loans

- Top 15 Personal Finance Mistakes to Avoid | Smart Money Tips

- Get Instant Personal Loan in Minutes with PayMe – Guide to Apply it Online

- 6 tips for how to get a Personal Loan without any hassle